office@charteredchoice.in

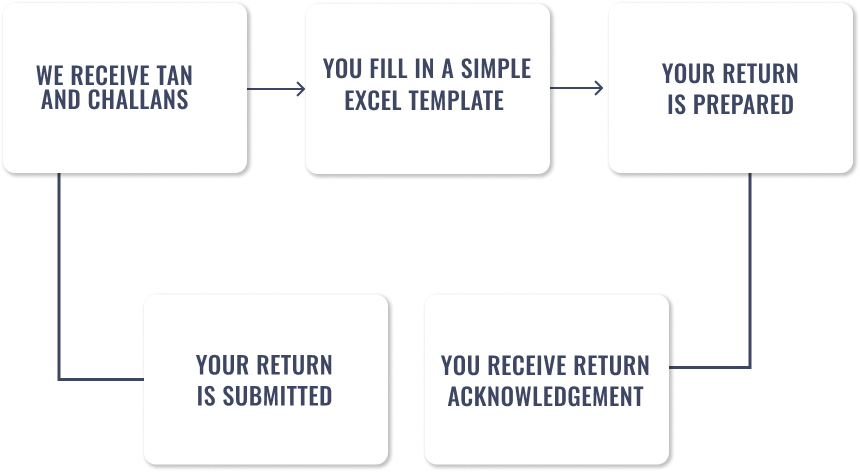

File Your TDS Return Today

Our Facts and Figures

What you need to Know

What is TDS return?

TDS is short for tax deducted from the source. According to the Income Tax Act any person or company making a payment must deduct tax from the payment if it exceeds certain threshold limits. TDS must be deducted according to the rates set by the tax department, and TDS returns need to be filed on the appropriate TDS return forms.

Important notes:

- Anyone who is required to deduct taxes at source must file a TDS return.

- This is a statement that has to be sent to the Income Tax Department of India.

- If you are a tax deductor, it is compulsory to submit TDS return.

- You should include all the details of TDS you have deducted and deposited for that quarter.

Prerequisites for TDS return filing

- You will need a valid TAN and PAN to file a TDS return.

- Details of the transaction and payment.

- All types of payments, such as salaries, interest, professional fees, payments to contractors, rent of machinery, rent of buildings, etc., are usually covered by liable payments.

- The Income Tax Act of 1961 prescribes rates for all types of TDS payments.

Read this for more information Chart of TDS rates for FY 2022-2024

Types TDS Return Forms:

For PARTNERSHIP/Pvt. Ltd. COMPANY

FOR Proprietorship Firm Registration

Who is required to register for the GSTIN?

Businesses in the following categories should register for GST:

-

Goods Manufacturers who have a turnover exceeding 40 lakhs

-

Service Providers With a Turnover Above 20 Lakhs

-

Voluntary Registration

-

Inter State Sales

-

Non-Resident taxable person

-

Online GST Registration Certificate in India for Businesses in More Than One State

-

Register for GST For Businesses that have previously registered under VAT, Excise Laws or Service Tax Laws

-

E-commerce businesses and GST registration

-

Providers of Services and Goods Outside India

GST Registration Fees

The Online GOODS AND SERVICE TAX Registration is different in terms of the GST registration fee & pricing.:

Depending on their type, all registered businesses must file Goods & Service Tax returns monthly, quarterly or annually. Special cases, such as composition dealers, are required to file different returns. You can compare the prices of GST registration on Chartered Choice, as it provides a list of professionals providing GST services.

What is the Goods and Service tax Return?

The return is the final document that contains all of the details about income and is filed with the tax administration authorities. The return’s importance is in calculating the tax liability.

How to Complete GST Return Filing

A registered dealer is required to submit Goods & Service Tax Returns that include the following:

- Purchases

- Sales

- Output GST (On sales)

- Input tax credit (GST on purchases)

- Tax returns are required.Taxes for late filing of GST returns

You will have to pay late fees and interest if you do not file your GST return on time. With the help of a chartered account, or company secretary providing GST services, you can file your GST return on time.

The interest rate is 18% per year and must be calculated on the outstanding tax amount. The GST return filing deadline is from the day after filing until the date payment. For GST filing, the maximum late fee is Rs. 5000/.

GST registration consultants are a great way to ensure a smooth and easy registration. They are aware of the various turnover limits that require registration under the Act.

The following is a list of special categories under GST:

- Arunachal Pradesh

- Assam

- Jammu and Kashmir

- Manipur

- Meghalaya

- Mizoram

- Nagaland

- Sikkim

- Tripura

- Himachal Pradesh

- Uttarakhand

DS returns filing - Mandatory norms

Documents Required for TDS Returns

Quick Checklist

Our clients say