File Annual Returns

For Trust

Each Producer Company is required to file returns annually. Comply with the Producer Company ROC

Get in Touch

Annual Filing for Trust in India

What is a trust?

A trust is an organization that is legally formed, where the trustor is the owner and the beneficiary is the trustee. Forming a trust has as its main goal to facilitate the transfer of property from the trustor (owner) in the name the beneficiaries. The Indian Trust Act of 1882 governs all trusts registered in India. Hence, the registered trusts of India will have to comply with the legal provisions contained in the Act. In addition to the provisions for the registration and operation, these legal provisions include compliance requirements such as Income Tax Return Filing or Audit Report Filing. Trust in India.

Trust in India: Types of Trust

Public Trust

Public Trusts are organizations that benefit the general public or other classes of people. They are not limited to one group. Public Charitable Trust is the name of a trust that has a charitable purpose or religious intention.

Private trust

A private trust is a type of organization that is set up to benefit a certain person or group of people.

Annual Reporting of Trust India

As mentioned below, once a Private Trust has been formed, it must comply with multiple laws.

- Indian Trust Act of 1882

- 1961 Income Tax Act 1961

- Bombay Public Trust Act of 1950

In addition, Private Trusts must also comply with various provisions of the State Legislation.

Annual compliance / filing for Trusts in India

Accounts of Trusts are subject to compulsory auditing

If the income of a private trust exceeds the Income Tax Act 1961 limit for non-taxable income in a financial year, it is mandatory to audit the accounts of these Private Trusts.

Tax Return for Trust

For Income Tax purposes, trusts are taxed as a separate legal entity from their trustees. This means that the trustees will have to file an Income Tax Return separately for the trust.

The Financial Accounts and Audit Report prepared by an experienced CA shall be submitted to the Income Tax Department with the Annual Income Tax return in Form ITR 7, on or before due date.

TDS Certificate

The trust must issue TDS certificates to those people who were collecting TDS on behalf of the Private Trust. The TDS Certificates must be issued within one month of the end of the financial year.

Publication of accounts in newspapers

The trust must publish its annual accounts if it generates an income or receives receipts of more than INR 10,00,000.

Tax Returns for Trusts

GST will be applied to all services provided by the trusts, except for those that are specifically exempt. There is no exemption for the supply of goods to Charitable trusts. GST is payable on any goods sold or supplied by Charitable Trusts.

Form 10A for charitable Trusts

If the trust has a registered charitable or religious purpose, it must register under Section 12AB (previously Section 12A) as well as Section 80G in order to qualify for the exemption under Income Tax Act. To this end, the Public Charitable or Religious Trust must file Form 10A in accordance with the Income Tax Act.

Documents required for Trust Annual Filing

Name and Address of the Trust

Name and Address and Aadhar Card of the Trustees

PAN Card of the Trust

Audit Report prepared by CA (including Audit Report, Income and Expenditure Statement, Contribution Calculation, Balance Sheet, etc.)

Affidavit of the Trustees

Other Documents, if required

What is the Online Annual Return for a Trust?

Online Annual Reporting for Trusts

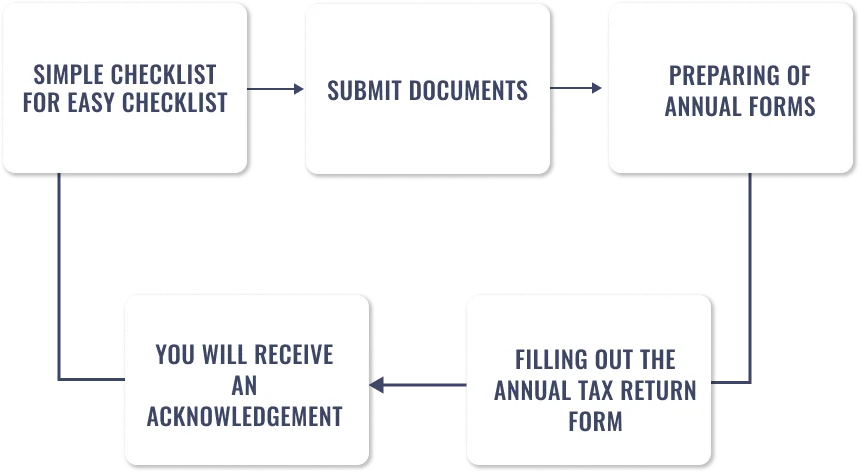

Fill out a simple Checklist

Fill out a simple Checklist

A compliance manager will contact you to collect documents and a simple check-list. This checklist must be completed and submitted with the documents to be verified. Our experts will check the details and documents you provide and continue the process.

Preparation Forms

Our expert team will begin the return preparation process once we receive the documents required for processing Annual Compliance. Your dedicated Compliance Manager will update you on the status of the Trust Annual Filing process.

Filling out Forms

Before we file your Annual Compliance Forms with the relevant authorities, we will review them. We will then file the Trust Annual Report Forms online once you have approved it. We will send the acknowledgement receipt to your email address after successful submission.

FAQs of Producer Company Annual Filing

The deadline for filing the Income Tax Return of trusts whose accounts do not require auditing is 31st of July. The due date for filing ITRs is 31st Oct.

A trust is a contract between two parties whereby one party holds assets for the benefit and enjoyment of another. A trust may be Charitable Trust, or Non Charitable Trust. A Society is an association of people who have come together to initiate a literary, scientific, or charitable purpose. The purpose of both Trust and Society may be the exact same but the organizational structure differs.

Our clients say

While perfection is a pursuit, the expertise and commitment provided by this firm in handling GST and financial services are exceptional. Their attention to detail and client care truly set them apart

ForExchain

Travel Agency

The dedication and professionalism shown in managing my GST and financial services have been outstanding. Their thorough approach and reliable support make them an invaluable partner for any business

OMNI Mart

E-commerce

Absolutely good in providing audit services, with thorough attention to detail and a deep understanding of financial processes. Their professionalism, accuracy, and client-focused approach make them a reliable partner for all auditing needs

Yajurvid Pharma

Manufacturer

Their proactive approach ensures that we consistently improve and evolve together for better results. There’s always room for growth, the continuous dedication to enhancing our services reflects a strong commitment to client satisfaction.

Royal Renewable Energy

Energy

Almost Perfect, The team has done a fantastic job handling my Audit and financial needs. There’s just a small bit of potential for improvement, but overall, the service is outstanding and highly dependable

Aurasun

Energy

Strongly Recommend, Their professionalism and deep knowledge of Aduit, Accounting and financial services set them apart. While I can confidently say I’m very satisfied, I believe a touch more flexibility would make them truly unbeatable

Naira Constructions

Construction

Truly impressive in every aspect, from their expertise in Audit and financial accounting services to their consistent professionalism. Their ability to deliver quality solutions speaks volumes about their commitment to excellence

Travelin

Travel Agency