office@charteredchoice.in

Digital Signature

Our Facts and Figures

Digital Signature

What is Digital Signature Certificate (DSC)?

A Digital Signature Certificate (DSC) is a secure key that certifies and validates the identity of a person who holds this certificate. It’s issued by the Certifying Authority. DSC Certificate uses Public Key Encryption (or electronic signature), meaning that data digitally signed by a private or encrypted with a public key can be decrypted only by the corresponding private key.Digital Signatures are classified into three classes: Class I, class II, and class III.

Who is required to have a Digital Signature Certificate in accordance with MCA21?

- Director

- CA’s/Auditors

- Company Secretary, whether in practice or on the job.

- Bank Officials for Charges Registration and Satisfaction

- Other Authorized Signatories.Credentials required with Application Form

Types TDS Return Forms:

For PARTNERSHIP/Pvt. Ltd. COMPANY

FOR Proprietorship Firm Registration

No, you can do it all online. You can start the process online if you have all the documents and fees ready.

Chartered Choice, for example, can help you register import export codes online.

You don’t have to be registered to apply for an import export code. Individuals can also apply. IEC Certificate can also be called Export License, Import License. IE Code, IEC Code, EXIM License. All of these terms have the same meaning.

Important: According to the latest notification from the DGFT you need to renew/update your IEC License each year between April and June.

Digital Signature Certificate

Documents required for DSC Application

Fill out a simple Checklist

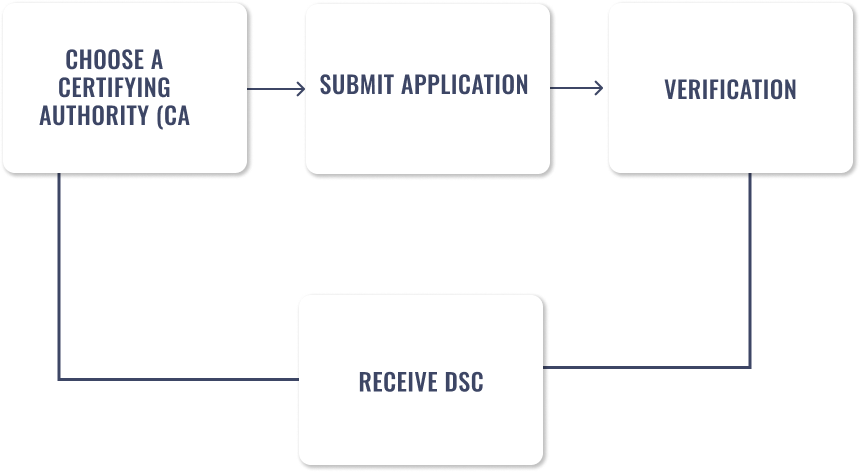

4 easy steps

FAQs of digital signature

What is a digital signature?

Digital signatures are a convenient and time-saving method of signing online documents or authenticating transactions. They are simple, safe, convenient, as well as secure. It is technically a unique code that is only known to the person signing the document electronically or authenticating the online transaction.

What is the 'DSC?'

Digital Signature Certificate is also known as DSC.

What is the difference in a Digital Signature Certificate (DSC), a Digital Certificate and a Digital Signature?

The terms digital signature and digital signature are used almost interchangeably.

Does a digital sign-off have legal validity?

Digital signatures are legal in India under the Information Technology Act 2000.

Can a signed document with a digital sign be used as evidence?

The Indian Evidence Act of 1858 was modified in accordance with the Information Technology Act 2000. Any electronic document that is signed with an acceptable digital signature will be considered as valid evidence, just like a document with a signature.

Why has digital signature usage in India increased so dramatically in the last few years?

MCA21 is a program launched by the Ministry of Company Affairs, Government of India. It allows businesses and citizens to easily and securely access MCA services. MCA21 aims to offer services anytime, anywhere to businesses. This is the first e-government project in India to be based on a mission mode.In addition, the use of a digital signature is now mandatory in certain transactions. Although digital signatures are not required in certain situations, they offer a great deal of convenience compared to traditional methods.In recent years, digital signatures have been used more and more in India. This trend is likely to continue.

Can more than one person have the same digital sign?

A digital signature cannot be used by two or more people/entities.

Can a digital sign be faked?

A digital signature is virtually impossible to fake. It has been used online to authenticate. It is therefore more secure than handwritten signatures, which are easily readable and can be imitated by anyone who comes across a document with a handwritten signature.

What is the validity period of a digital signature?

You can select a digital sign with a validity of either 1 or 2 years from the date it was issued.

What happens after a year or two years?

The digital signature is invalidated after the expiration of the validity period. A simple procedure can be followed to obtain a digital signature.

What cities do you serve?

Ebizfiling.com offers DSC Application in India. With us, you can easily obtain DSC Applications in Ahmedabad Mumbai Pune Bangalore Chennai Delhi Kolkata Kanpur Nagpur Jaipur and other cities.

Our clients say