office@charteredchoice.in

EPF Registration

Our Facts and Figures

EPF Registration

What You Need to Know

The Employees Provident Fund Organization (EPFO) of India implements it. The Employees Provident fund Organization (EPFO), India, implements it. The registration must be completed within one month of the date that 20 employees are hired. PF is a great way to offer social security for employees.

The Provident Fund PF, as prescribed by the government, is a scheme of employee benefits that provides assistance to employees in the areas of medical aid, retirement, child education, insurance and housing. The purpose of the fund is to give employees financial stability and security.

Contribution to EPF

- Both Employer and employee must contribute to the EPF.

- The employer deducts the employee’s share of EPF (Employee Contribution Fund) from his salary.

- The employer must deposit his EPF contribution along with the employee’s share.

- The employer’s contribution would be 12 % and the employee’s would also be 12 %.

Types TDS Return Forms:

For PARTNERSHIP/Pvt. Ltd. COMPANY

FOR Proprietorship Firm Registration

Why should I contribute to the EPF?

- Employer contributions to PF are tax-free.

- After a certain period, the amount plus interest is exempted from tax.

- Organizations can also voluntarily enroll under PF laws.

Note: Delays in the registration of EPFs (Employee Provident Funds) can result in penalties.

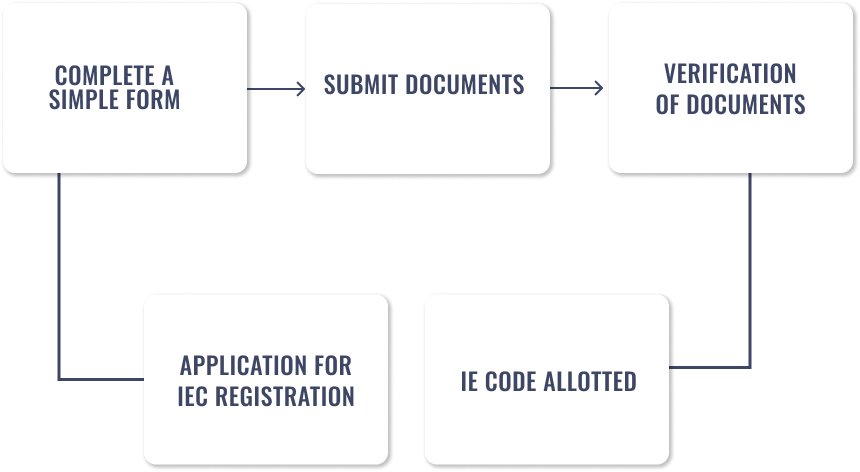

EPF Registration Process for Employers: Step by Step

EPF Registration: Key Features

-Employer – 12% of basic salary

-Withdrawal at maturity or after 5 years

-Emergencies, death or disability

-Documentation is easy and processing is faster

-Pension & Insurance after retirement

-Transferring accounts when changing jobs

Documents required for EPF registration

Fill out a simple Checklist

5 easy steps

Frequently Asked Questions

How do I register my employees' EPF accounts?

Follow the steps below to register for EPF.

- Register your organization with EPFO.

- Read the User Manual thoroughly.

- Register for the Digital Signature Certificate.

- The employer and employee details must be filled in correctly.

These simple steps will help you to easily register your employees for EPF.

How do I check the balance of my EPF?

By obtaining your Universal Account Number (UAN) you can check the balance of the Employees Provident Fund.

You can check your EPF account easily online once you have received your UAN by visiting the EPFO site. Employees’ Provident Fund Organization

How Many employees are required for EPF account registration?

EPF is an employee-based social security program that helps employees save a portion of their income for future needs.

EPF is compulsory for all establishments, but certain conditions must be met.

- Establishments with 20 or more employees

- The Central Government may, by giving a notice in writing of at least two months to all establishments with less than 20 workers, bring them under EPFO jurisdiction.

- If both the employee and the employer have accepted the provisions of the act, they can then directly contact the central PF commissioner.

Is the Employee Provident Fund (EPF), mandatory?

Contribution to the EPF is compulsory for those with a salary of up to INR 15,000. Those earning more than 15,000 can opt in voluntarily.

Is EPF Online Registration Mandatory?

All establishments must register an EPF account, but certain conditions have to be met.

- Establishments with 20 or more employees

- The Central Government may, by giving a notice in writing of at least two months to all establishments with less than 20 workers, bring them under EPFO jurisdiction.

- If both the employee and the employer have accepted the provisions of the act, they can then directly contact the central PF commissioner.

What is UAN in EPF account registration?

EPF UAN registration is a unique number that is assigned to an individual when he joins EPFO. EPF account registration gives you an EPF-UAN which you can use to access all services related to your EPF online. EPF account services, such as withdrawals, EPF balance checks, EPF loan applications, EPF UAN registration, etc. Registration of EPF accounts is required to perform all services.

Our clients say