office@charteredchoice.in

File Annual Returns

For Public Limited Company

Our Facts and Figures

What is ROC annual filing for Public Limited Company?

What Is a Public Limited Company

- A Public Limited Company (PLC) is a limited liability company that sells shares to the public.

- A Public Limited Company must also disclose its true financial situation to its shareholders.

Annual Report of the Public Limited Company

- Public Limited Companies must comply with the most regulations every year compared to all other types.

- According to the Companies Act 2013, every Public Limited Company is required to submit an annual filing.

- Public Limited Companies must file their balance sheet, P&L account and other documents at MCA.

- The Annual Report is a totally different department from income tax and it’s managed by the Ministry of Corporate Affairs.

Due dates for filing annual reports for the fiscal year 2023-24

Benefits of Public Limited Company Annual Reporting

- Transparency is created when companies comply with the law. Regular compliance with company law increases the credibility of a company.s.

Types TDS Return Forms:

For PARTNERSHIP/Pvt. Ltd. COMPANY

FOR Proprietorship Firm Registration

- The clients are assured that the company regularly reviews its operations through the annual compliance. They can then trust the company with their operations.

- The annual compliance can give you a competitive advantage in the market. The annual compliance can be used to advertise the business and assure investors or customers of the company’s performance.

- The companies must ensure that all data collected to comply with the annual compliance are correct.

- Small businesses often end up paying heavy fines for not adhering to annual compliances. Regular annual compliances will help you avoid heavy penalties.

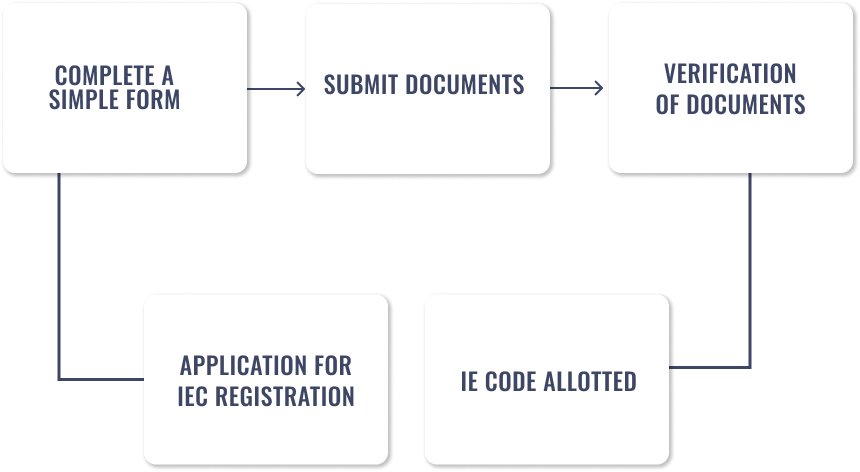

Annual Company Filing Process for Public Limited Company

Documents needed for Public Limited Company Annual Filing

Fill out a simple Checklist

5 easy steps

FAQs of ROC Filing Public Limited Company

What is an Annual Return for a Public Limited Company ?

Every year, the annual return along with other documents such as the P&L account and balance sheet is filed. The Ministry of Corporate Affairs is responsible for this department, which is separate from the Income Tax Department.

Who signs the Annual Report?

Two directors must sign the Annual Return.

What is the audit requirement under Companies Act 2013?

This is a mandatory requirement, regardless of the capital or turnover.

Who is responsible for filing the annual return?

The annual return can be presented by any director, but must be signed by both directors and the manager or company secretary. In certain situations, there may not be a Manager/CS within a company. The signatures of both directors are required.

What is meant by Financial Statements?

The MCA requires that all COMPANY’S registered there submit a ‘Balance sheet and Profit & loss statement with Directors’ Report, and Auditors’ Report’. This should include a declaration of the company’s solvency. The directors are responsible for this.

Our clients say