office@charteredchoice.in

File Annual Returns

For NGO / NPO / Section 8 Company

Our Facts and Figures

ROC Annual Filing for NGO / NPO / Section 8 Company

What does a Non Government Organization (NGO) mean?

- Non-Profit Organization is a trust or company, or any other group of people, which has been established for a public cause.

- Income and property from such an organization is not distributed to members or officers except for reasonable compensation.

- In India, Non Profit Organization (NGO) includes all types of Non Profit Organizations i.e. Trust, Society, and Section 8 Company.

- In a Charitable Trust, at least two members are required. There is no limitation for members in a group.

- A minimum of seven people are needed to form a society.

- The Registrar of Companies can register a non-profit company under section 8 of Companies Act.

- These non-profit organizations can also be called “Sangathan”, “Sangh”, or “Sangam”. All non-profit organizations are eligible for income tax exemptio

Annual compliance of NPO/NGO/Section 8 company

The Companies Act of 2013 is the law that governs Section 8 Companies. The Section 8 Company must comply with the Compliances mentioned in said act. The Section 8 Company must follow the compliances set by the Ministry of Corporate Affairs.

Benefits of Section 8 Annual Compliance

-

- The Section 8 Company will gain more credibility and trust if they regularly comply with all the regulations.

- The Section 8 Company can also raise money for causes.

Types TDS Return Forms:

For PARTNERSHIP/Pvt. Ltd. COMPANY

FOR Proprietorship Firm Registration

- The regular filing of Annual Returns ensures that the organization will continue to exist.

- The company can avoid legal problems by being compliant and adhering the annual compliance requirements.

- It also helps Section 8 Company to protect itself from penalties and sanctions.

- Section 8 Company’s main goal is to build trust with its customers. Being regular in filing the annual return will help achieve this.

How to make a decision easier

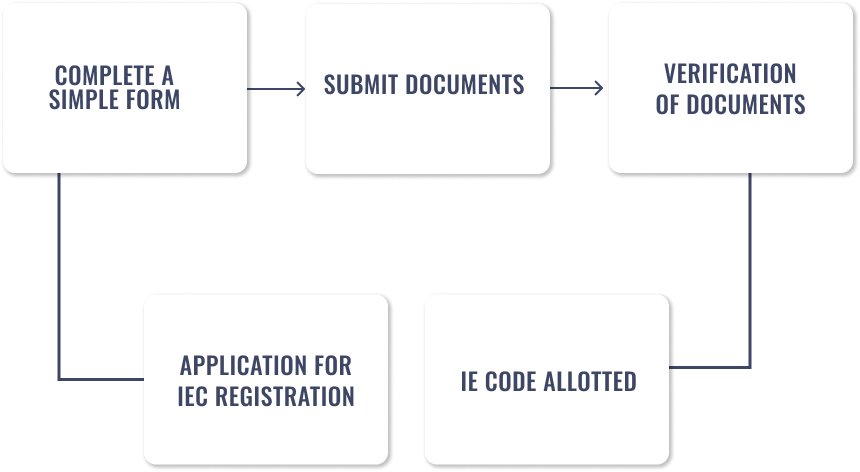

Section 8 Annual Filing Process

Documents required for Annual Compliance for Section 8 Company / NGO / NPO

Fill out a simple Checklist

5 easy steps

FAQs of NGO / NPO File Annual Returns

What will happen if the Annual Return for a Section 8 Company is not filed?

Every year, the annual return along with other documents such as the P&L account and balance sheet is filed. The Ministry of Corporate Affairs is responsible for this department, which is separate from the Income Tax Department.

Can section 8 companies receive money from non-residents or overseas?

According to the Foreign Contribution and Regulation Act 2010, Section 8 Companies must meet special requirements in order to receive funds, contributions or donations coming from abroad or outside India. If a Section 8 Company wants to receive money from a foreign country, they must obtain FCRA registration.

Why should I comply with annual compliances?

The Annual Compliance for Section 8 Company must be filed. Second, it provides benefits of filing compliances such as Avoiding Penalties and Building Trust. Transparency of Operations. Avoiding Legal Issues. And Increasing Credibility.

Who is responsible for filing the annual return?

The annual return can be presented by any director, but must be signed by both directors and the manager or company secretary. In certain situations, there may not be a Manager/CS within a company. The signatures of both directors are required.

Our clients say