office@charteredchoice.in

File Nidhi Company’s Annual Filing

Our Facts and Figures

What is the annual filing of Nidhi Company?

Nidhi Company:

Nidhi literally means ‘fund, finance or treasure. The Nidhi Company was formed with the purpose of encouraging its members to save, reserve and invest their funds. They also receive deposits from its members for mutual benefit.

Although there is no separate registration to be made under RBI for Nidhi companies, RBI can still issue directives. The Nidhi Company must meet the following minimum requirements to be registered:

- Minimum of seven members

- Minimum 3 directors

- The name of the company must be “Nidhi limited”

- Within one year of its start, every Nidhi firm must have at least 200 members.

Nidhi Company annual FIling :

Nidhi Company must file its returns twice a calendar year, and yearly returns with ROC once a year. Nidhi Company must also file their Financial Statements (Form AOC 4) and Annual Return (Form MGT 7) annually with ROC.

The following are the forms that Nidhi Company is required to file every year with ROC :

- Form NDH 1

- Form NDH 3

- MCA Form MGT 7.

- MCA Form AOC 4.

Each Nidhi Company must comply with the provisions of the Companies Act, 2013, and Nidhi Rules 2014. Every Nidhi Company can be considered a Public Limited Company. It is therefore necessary to comply with all provisions that apply to Public Limited Company, unless it has been exempted.

Types TDS Return Forms:

For PARTNERSHIP/Pvt. Ltd. COMPANY

FOR Proprietorship Firm Registration

Annual filing of Nidhi Company Forms that need to be filled out

Documents required for Import Export Code

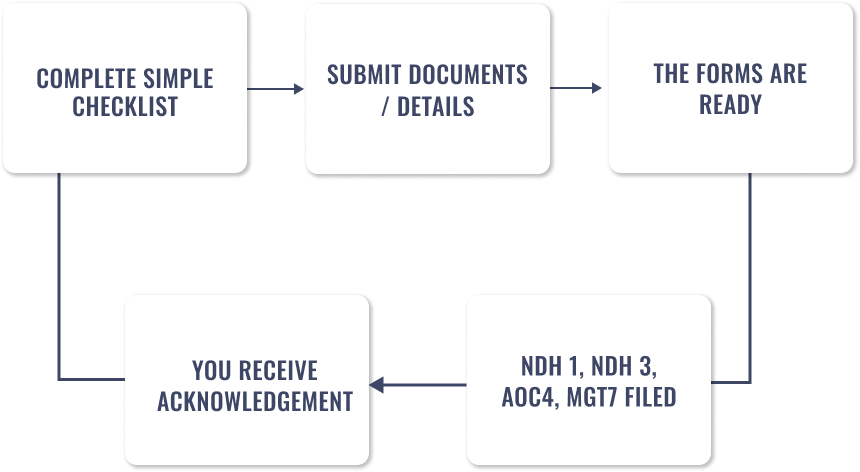

5 easy steps

Fill out a simple Checklist

FAQs on Income Tax Returns

Do Nidhi Companies need to file an Annual Return?

Each Nidhi company must file an annual report. Once the prescribed fees are paid to the Registrar, you can also inspect your annual return.

What forms must a Nidhi-owned company file?

Form AOC-4 : for filing financial statements and other documents

MGT-7 : Form to be filed by companies with share capital

Form NDH-1 : Statutory Compliance

Form NDH-3: Half-yearly compliance

When will Form NDH 3 be due?

Each Nidhi Company must file Form NDH-3 within 30 days of the end of each half-year.

When is the deadline for investing under Section 80C?

The deadline for investments under Section 80C has now been extended until 30th June 2020. This applies to the Financial Year 2019-20. The previous date was the 31st of March 2020. Nirmala sitharama Press Conference announced that other deadlines will be extended due to the Corona outbreak. 30thApril for the half-year ending 31stMarch and 30thOctober for the halves year ending 30thSeptember

When is the deadline for filing MGT 7 and AOC4?

MCA Form AOC4 must be submitted within 30 days of the date of AGM. For example, if AGM was held on 30th Sept then AOC4 due date is 29th Oct MCA Form MGT7 must be submitted within 60 days of the date AGM. If AGM falls on 30th Sept, then the due date for ROC Form MGT 7 would be 28th Nov.

Our clients say