office@charteredchoice.in

Registering a private limited company

Our Facts and Figures

Registering a private limited company

What will you receive?

- Digital Signature for 2 Director

- DIN numbers for 2 Directors

- Hard copies of MOA and AOA

- All Company Registration Process (Incorporation Certificate).

- Includes All Government Fees

- PAN Card

- TDS Number

- Opening a Bank Account (Documentation support)

Private Limited Company (PLC) is the best and most popular option for those who are looking to grow their business. This entity is registered under the Companies Act of 2013 and offers many benefits, including limited liability. It also ensures that personal property will be protected by a separate legal entity. It is preferred by start-ups and growing companies.In India, it is common to choose a private limited business as the preferred option when setting up a new business.

What is a limited liability company?

Private limited companies are a form of business entity that is privately owned and has limited liability. They are popular in India. Its popularity can be attributed primarily to its many advantages, such as limited liability protection, its ease of formation and upkeep, and the fact that it is a separate legal entity.

Types TDS Return Forms:

For PARTNERSHIP/Pvt. Ltd. COMPANY

FOR Proprietorship Firm Registration

Private limited companies are legally separate from their owners, and require a minimum of 2 members and 2 directors to operate. These are the main characteristics of a limited company in India.

- Limited liability protection:

Shareholders in a private limited corporation are only liable to the extent that their shares. Even if the company suffers financial losses, their assets are protected. - Separate legal entity:

Private companies have their own distinct identity. Under its unique name, it can be a property owner, enter into contracts, or initiate or defend legal proceedings. - Minimum Shareholders:

Private companies must have at least two shareholders, and they cannot exceed 200. - Minimum number of directors:

For a private limited company, a minimum two directors are required. One of the directors must be a citizen of India. - Minimum share capital:

A minimum paid up capital of Rs. The company must maintain a minimum paid-up capital of Rs. - Name the firm:

Private limited companies must end their name with “Private Limited.” - Share Transfer Restrictions:

A private limited company’s right to transfer its shares is restricted. Only the Board of Directors can approve the transfer of shares. - Public invitation prohibited:

It is illegal for private limited companies to invite the public to subscribe their shares or debt securities. - Compliance requirements:

Private Limited companies must adhere to a variety of legal and regulatory obligations. These include maintaining financial records and conducting annual general meetings. They also have to file annual returns to the ROC.

Private limited companies:

- Company Limited By Shares:

The liability of the shareholders is limited to the nominal amount of shares stated in the Memorandum of Association. - Company Limited By Guarantee:

Member Liability is limited to the amount of the guarantee specified in your Memorandum of Association. This guarantee can only be invoked during the winding-up process. - Unlimited companies:

Members who are members of unlimited companies can be held personally liable for all debts and liabilities. They are considered to be a separate legal entity and the members of these companies cannot be sued.

Points that will make your decision easier

Private Limited Company Compliance

Documents Required for Pvt. Ltd. Company Registration

Benefits of a private limited company

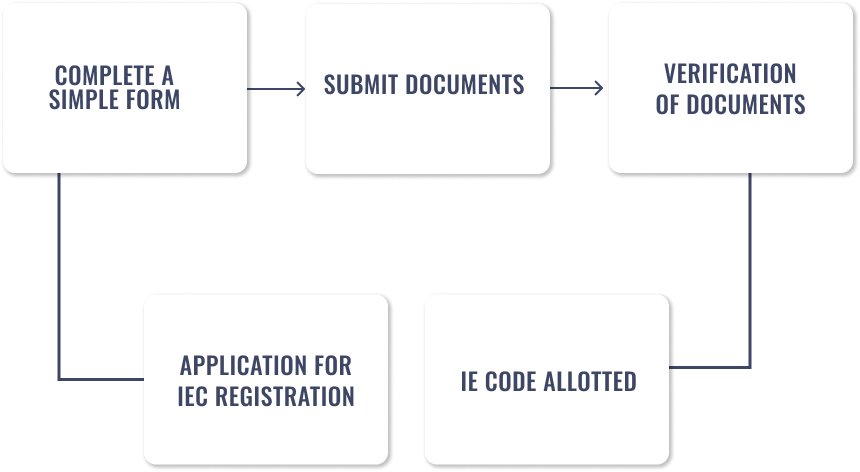

5 easy steps

FAQs of Producer Company Annual Filing

What is a private limited company?

Private Limited Company (PLC) is a business structure in which the shareholders’ liability is limited to their investment. It is a legal entity separate from its owners.

How many members are required to start a private limited company?

The minimum number of members to form a private limited corporation is two, while the maximum can be 200.

What documents are required for the registration of a private limited company?

Documents commonly required include proof of identity and address of directors, Memorandum of Associations (MOA), Articles of Associations (AOA), as well as proof of the registered office address.

Our clients say