office@charteredchoice.in

Partner Registration

Our Facts and Figures

Partner Registration

What is Partnership Registration?

Partnership Act of 1932 in India defines and regulates Partnership Firm. Section 4 of this Act states that a partnership is “an agreement between people who have agreed to split profits from the business carried out by them all or one of them acting on behalf of all.”

It is not mandatory to register a partnership, but it is often done because registration has many benefits for the firm. The partners can choose to register the partnership. There are no penalties if they do not. However, it is always recommended to get it done because it gives the firm a legal existence. The state website is where you can register your partnership.

Partnership Firms: Features and Benefits

- Governed by –Partnership Act of 1932

- Any business, profession or Industry

- Profit and Loss Sharing – Based upon a predetermined ratio

- Liability –Unlimited. It allows you to use your personal assets as a way to offset losses.

- Duration-Not Fixed, depends on partners’ wishes or what is specified in the partnership agreement. However, death/retirement/insolvency of any partner among the two auto-dissolves the partnership.

Types TDS Return Forms:

For PARTNERSHIP/Pvt. Ltd. COMPANY

FOR Proprietorship Firm Registration

Benefits of Partnership Registration

- Quick response & decision-making- Every partner can act independently for other partners. This allows the business to react quickly to problems, by reducing the amount of bureaucracy in the decision-making process.

- Profits are distributed to partners according to a predetermined ratio-Profits will be passed on directly to each partner in accordance with the Ratio set forth by the partnership agreement. The partnership profits are then taxed to each individual according to their own personal ratio.

Lower Commencement Cost and Less Formalities-Partnerships are low cost, have few formalities and limited external regulation. Low-cost partnership firms are simple to set up.

Points that will make your decision easier

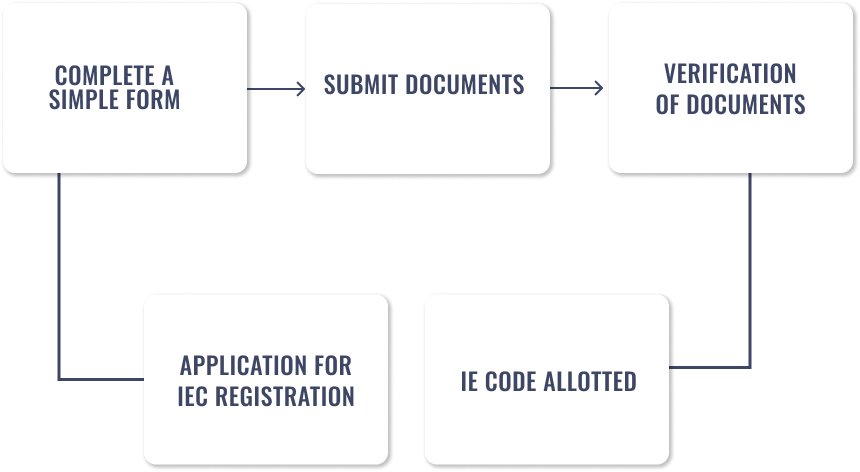

Process of Partnership Firm Registration

Documents Required For Partnership Firm Registration

Process of Partnership Firm Registration

Benefits of a private limited company

5 easy steps

FAQs of Partnership Registration

Do I need to register my partnership?

No. It is not mandatory to register a partnership but it can have the following effects if it’s not done:

- In order to assert rights, one cannot sue another partner or the firm against one’s own partner.

- The Partnership Firm cannot sue a third party to enforce its rights in a court of law.

What is the minimum capital requirement for registration?

No minimum capital is required to form a partnership firm. Capital contributions from the partners can start at any amount. Partners can contribute any agreed amount or/and any form, whether tangible (cash or premise), or intangible, (goodwill or intellectual property). Capital can be introduced by the Partners in any ratio.

How many people must be registered to form a partnership? Are there any requirements?

The process described above can be followed to form a partnership with just two partners. The Partners of the firm are also required to be Indian citizens and residents. Only non-resident Indians and persons of Indian origin can invest into a Partnership with the prior approval of government. Individuals must be competent and not minors. Minors can only be admitted for profit.

What are the benefits of registering a partnership?

- Quick response & decision-making- Every partner can act independently for other partners. This allows the business to react quickly to problems, by reducing the amount of bureaucracy in the decision-making process.

- Profits based on a predetermined ratio- Profits will be distributed to partners in accordance with their partnership agreement. The profits of the partnership are taxed to each individual according to their share.

- Low Start-up Cost and Fewer Formalities Partnerships are low cost, have few formalities, & face limited external regulation. Low-cost partnership firms are simple to set up.

- Does it matter if I have a partnership deed to register a partnership?

No, a partnership deed is not required for registration. The contract act does require that the agreement be in writing. It is wise to create a partnership agreement to be able to show it to the client, the income tax authority, and the bank. A written partnership deed serves as a reference and helps to reduce conflict and confusion over time.

Who can become a partner in a firm?

The Partners should be majors (i.e. The partners must be majors

How can a child become a joint partner upon reaching majority?

Minors can enjoy the benefits of partnership and have the option of becoming partners within six months after reaching majority. Adoptions are allowed after 18 years and in general 21 years. He must give public notice of his acceptance or rejection. It is assumed that, in the absence of a notice, he is a partner.

What are the limits of a partner?

As a partnership, you cannot do any of the following things without the consent from the other partners.

- Send a dispute about business to an arbitration panel;

- Open a bank in your name for the company.

- Compromise or give up any claim, or a portion of a firm’s claim;

- Retracting a lawsuit or proceeding brought on behalf of the firm

- Invoking a partnership on behalf of a firm with an external partner

- Transferring or purchasing a firm’s immovable assets;

- Acknowledging any liability in the case or proceeding against the company.

Can the right to be a partner be transferred to another outsider?

A partner can indeed transfer their interest in the company to an outsider, but only with the consent from all the other partners.

Our clients say