office@charteredchoice.in

Sole Proprietorship Registration

Our Facts and Figures

Sole Proprietorship

In India, a sole proprietorship can be a simple and convenient way to start a business. It is neither considered as a corporation nor a company where the business is owned by a single person who is the nowner/director/shareholder of the proposed entity.

Shops such as chemists, saloons and grocery stores are examples of common proprietorship businesses.

What is an Sole Proprietorship?

The sole proprietor is a living person who owns a sole proprietorship. He must also be an Indian national and a resident. A sole proprietor is entitled to all profits made by the business and is personally responsible for all losses.

The Basic Requirements for the Registration of a Sole Proprietorship and the Options Available

A sole proprietorship can be registered digitally with an expert’s help. To register as a sole ownership, an individual must meet certain requirements, such as opening a business bank account.

- Sole Proprietorship registration through Udyog Aadhaar in the Ministry of MSME

- Registration of sole proprietorship under the Shop and Establishment Act

- GST registration for sole proprietorship

Types TDS Return Forms:

For PARTNERSHIP/Pvt. Ltd. COMPANY

FOR Proprietorship Firm Registration

What is the compliance required?

As a sole owner, you are required to file Annual Income Tax Return. You must also file your GST return if you have registered for GST. If a sole proprietor is subject to a Tax Audit, they should deduct TDS from their income and file a TDS Return.

Points that will make your decision easier

The Benefits of a Sole Proprietorship in Jaipur

The cost of registering as a sole proprietorship is low compared to other types of organization. It is also an advantage because of the minimal compliance requirements.

Documents required for a sole proprietorship

registration in Jaipur

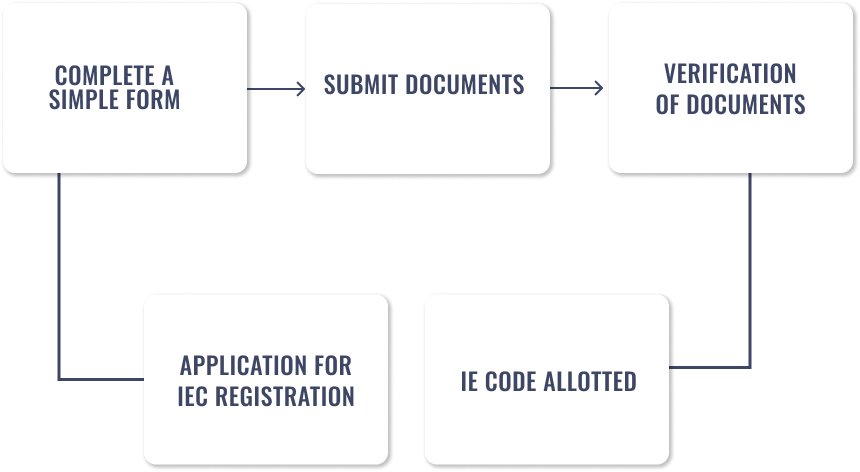

How to Register a Sole Proprietorship in Jaipur

According to the Goods and Services Tax Act of 2017, traders must register if their business turnover exceeds a certain amount. The turnover would be the annual business revenue. If the annual turnover of a service entity exceeds Rs. GST registration will be required if the annual turnover exceeds Rs. If the annual turnover of a trading company exceeds Rs. GST registration is mandatory for businesses with a turnover of more than Rs.

It is important to obtain the Tax Deduction Account Number from the relevant Income Tax Authority. The sole proprietor would need to do this if they are making salary payments. TDS System (Tax deducted at source). In the case of sole proprietorships, this would be only required for salary payments.Once the sole proprietorship registration procedure is completed, you can start your business.

5 easy steps

FAQs of Sole Proprietorship Registration

Who will start a sole proprietorship?

A sole proprietorship can be started by any Indian citizen with a bank account under the business name. Registration may or may not be required, depending on what kind of business is planned. To open a current bank account, the banks will need to have a Shops and Establishments Registration.

How long does it take to set up a sole proprietorship business?

It takes less than 15 days to start a sole proprietorship. Its simplicity is why it’s so popular among small merchants and traders. Of course, it is also cheaper. It is for this reason that it is most commonly used as a business structure.

What type of business is run by a sole proprietorship?

In general, local businesses, including grocery stores, fast-food outlets, small traders, and manufacturers, are operated by sole proprietors. It’s not that large businesses can’t be sole proprietorships. They certainly can! Jewelry retailers can be sole proprietors. However, it is not recommended.

What should I do if I want to change from a sole proprietorship to a private limited company or partnership?

It’s possible that the procedure could be very tedious. At a later stage in their business, it’s not uncommon for sole proprietors or small businesses to become partnerships or private limited corporations.

Can a sole owner hire employees?

Employees can be hired by sole proprietors. Employees and workers are essential to the success of small businesses and MSMEs. The number of workers that a MSME can employ is not limited.

Can FDI in a proprietorship be allowed?

Yes, Foreign Direct Investment in sole traders is permitted. There are certain conditions that must be met to receive foreign direct investment as a sole proprietorship.

Can a sole proprietorship change its name?

The name of a sole proprietorship can be changed. Public and government announcements are required to inform the public of any name change. The sole trader must also inform the parties concerned about the name change.

Can a sole proprietorship have any name?

As long as the name is not offensive, it can be used as the sole proprietorship.

Our clients say